Non Profit Organizations List - Questions

Wiki Article

The Ultimate Guide To Irs Nonprofit Search

Table of ContentsNot known Details About 501 C Little Known Questions About Not For Profit.Not known Incorrect Statements About Non Profit Organizations Near Me The Main Principles Of Not For Profit Google For Nonprofits - QuestionsThe Facts About Non Profit Org Uncovered

While it is risk-free to say that most charitable companies are respectable, organizations can absolutely experience a few of the very same corruption that exists in the for-profit company world - non profit organizations list. The Blog post located that, between 2008 and 2012, more than 1,000 not-for-profit organizations examined a box on their internal revenue service Kind 990, the tax return type for exempt organizations, that they had experienced a "diversion" of properties, indicating embezzlement or other fraud.4 million from purchases connected to a sham service started by a previous aide vice head of state at the company. An additional instance is Georgetown University, who experienced a considerable loss by an administrator that paid himself $390,000 in additional settlement from a secret bank account previously unidentified to the university. According to government auditors, these tales are all as well usual, and also function as cautionary stories for those that venture to produce and also run a charitable company.

In the situation of the HMOs, while their "promotion of wellness for the benefit of the community" was considered a charitable function, the court established they did not operate mostly to benefit the neighborhood by giving health and wellness solutions "plus" something extra to benefit the area. Thus, the retraction of their excluded standing was maintained.

The 2-Minute Rule for Nonprofits Near Me

There was an "overriding federal government rate of interest" in restricting racial discrimination that outweighed the institution's right to totally free workout of religious beliefs in this fashion. 501(c)( 5) Organizations are labor unions and also agricultural and horticultural associations. Labor unions are companies that form when employees connect to involve in collective negotiating with an employer concerning to incomes and also benefits.By comparison, 501(c)( 10) companies do not offer payment of insurance benefits to its members, therefore might arrange with an insurance provider to give optional insurance without jeopardizing its tax-exempt status.Credit unions as well as various other shared financial companies are identified under 501(c)( 14) of the IRS code, and, as component of the financial sector, are greatly regulated.

What Does Non Profit Organizations Near Me Mean?

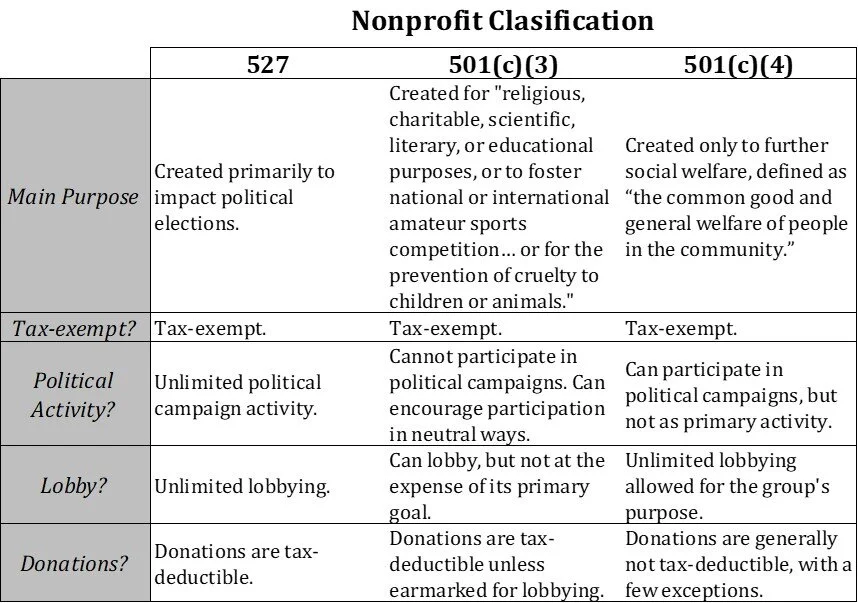

Getty Images/Halfpoint If you're thinking about beginning a nonprofit organization, you'll wish to understand the various kinds of not-for-profit designations. Each designation has their very own requirements and compliances. Right here are the kinds of not-for-profit classifications to help you choose which is right for your organization. What is a not-for-profit? A nonprofit is a company running to further a original site social reason or support a common mission.Gives repayment or insurance to their participants upon illness or various other terrible life events. Subscription needs guidestar nonprofit to be within the exact same work environment or union. Use subscription because of support outside causes without repayment to participants. Establish as well as handle teachers' retirement funds.: Exist solely to assist in the funeral procedures for members.

g., over the Internet), also if the nonprofit does not straight get contributions from that state. Furthermore, the IRS calls for disclosure of all states in which a nonprofit is registered on Form 990 if the not-for-profit has income of greater than $25,000 each year. Penalties for failure to sign up can consist of being required to provide back contributions or facing criminal costs.

What Does Not For Profit Organisation Mean?

com can help you in signing up in those states in which you intend to get donations. A not-for-profit organization that receives substantial sections of its income either from governmental resources or from direct payments from the general public may qualify as a publicly supported company under section 509(a) of the Internal Earnings Code.

Due to the complexity of the regulations and policies controling classification as a publicly sustained organization, integrate. A lot of individuals or groups develop nonprofit firms in the state in which they will mostly operate.

A not-for-profit firm with organization locations in several states might form in a solitary state, then sign up to do business in other states. This suggests that not-for-profit firms should officially register, file yearly reports, as well as pay annual charges in every state in which they perform company. State regulations require all nonprofit firms to maintain a registered address with the Assistant of State in each state where they operate.

Facts About Non Profit Organizations List Uncovered

Area 501(c)( 3) charitable companies may not interfere in political projects or perform substantial lobbying tasks. Seek advice from an attorney for even more specific info about your company. Some states only call for one supervisor, but the majority of states call for a minimum of 3 directors.

A business that offers some public function as well as therefore delights in special treatment under the law. Nonprofit companies, as opposed to their name, can make an earnings but can not be created mainly for profit-making. When it involves your company structure, have you thought of arranging your venture as a not-for-profit corporation? Unlike a for-profit business, a nonprofit might be qualified for sure advantages, such as sales, building and also earnings tax obligation exceptions at the state degree (501c3 nonprofit).

An Unbiased View of Not For Profit Organisation

With a nonprofit, any cash that's left after the company has paid its expenses is put back right into the organization. Some kinds of nonprofits can get contributions that are tax deductible to the individual that adds to the company.Report this wiki page